Governor Rick Scott was in Jacksonville Wednesday signing 53-pages’ worth of tax cuts into law.

The recurring and one-time cuts total $400 million.

But that’s significantly less than what Scott asked lawmakers to pass this year.

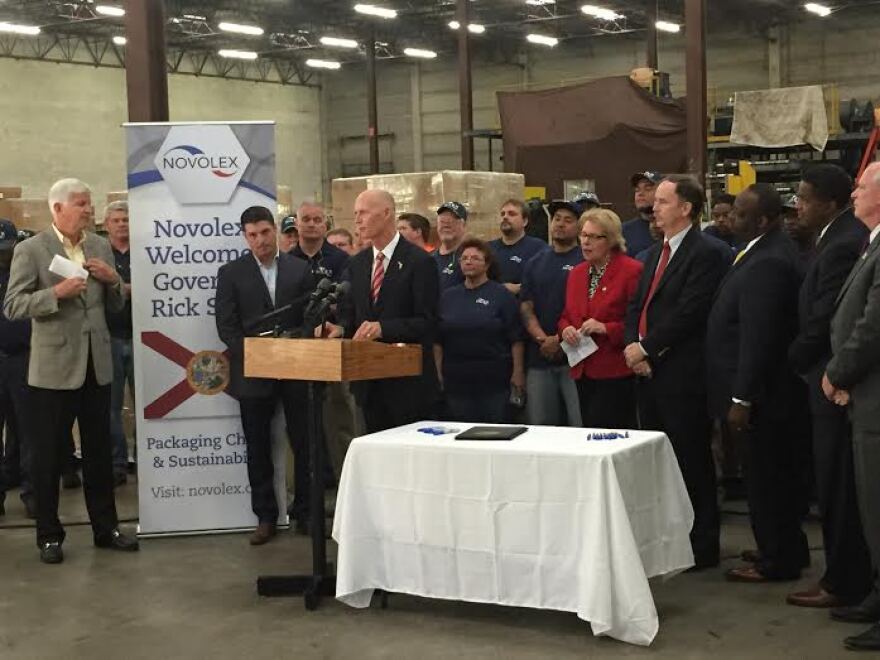

This scene has become familiar over the last five years. Scott is signing a tax cut at a factory — this time the Novolex plastic bag plant in Jacksonville — while announcing the creation of 25 jobs, which required no economic incentives on the part of the city.

He’s flanked by factory employees, Jacksonville Mayor Lenny Curry, Florida House Speaker Steve Crisafulli and Jacksonville Republican Representative Lake Ray.

“When I ran for reelection in 2014, one of the things we talked about was cutting $1 billion in taxes over two years,” Scott said. “One of the exciting things about the tax cut we’re doing this year is we’re going to permanently eliminate the sales tax on machinery equipment.”

But Scott had much loftier goals leading up to this year’s legislative session. The self-proclaimed "jobs governor" pushed lawmakers to pass a $1 billion tax cut plan, but lawmakers refused to play ball — some of them in retaliation as part of the state’s ongoing dispute over Medicaid expansion.

Still, Scott is claiming victory.

“We are heading in the right direction,” he said.

Even the more conservative Florida House of Representatives, who sided with the governor against the upper chamber’s private-sector Medicaid expansion plan, had questions about Scott’s math, which didn’t include a plan to deal with a looming $400 million health budget shortfall as a result of losing federal funding for indigent care.

Eventually, though, the House did pass a shorter-term $1 billion tax cut plan in February without resoundingly endorsing the package. And what Scott eventually signed might actually be even smaller than it already appears. Of the $400 million in cuts, $290 million stem from reducing the state’s required property tax rate for schools by 5 percent.

The last $110 million is made up of extending sales tax holidays, including the back–to-school break and the permanent cutting of manufacturing equipment sales taxes.