Anyone in Florida who has opened a home insurance bill in the last few years knows premiums have been skyrocketing. New estimates from a data analysis company shows they’ve actually been rising faster than in any other state — a lot faster.

The numbers show just how massive the impact has been on the wallets of Florida consumers, with home insurance costs up about 57% since 2015, according to LexisNexis Risk Solutions. That’s nearly triple the national average (21%) and far outpaces Nebraska, the state with the second-biggest average home insurance hike (43%).

Climate change may take some of the blame: Warming oceans and an altered atmosphere are making hurricanes more likely to rapidly intensify and may make stronger storms more frequent. A recent run of hard-hitting hurricanes has pushed several Florida insurers into insolvency.

READ MORE: Insurance company insolvencies hit Florida policyholders in the wallet

But there are also other, more mundane causes, according to insurance experts. Inflation has driven up the cost of materials and labor to repair or rebuild a house. Rising interest rates have raised the cost of borrowing for insurance and reinsurance companies. Developers keep building pricey homes in vulnerable floodplains and along eroding coasts. And new residents keep flooding into them, concentrating the state’s insurance risk.

All these factors have created an insurance crisis that’s driving up the cost of living for homeowners and renters from the Keys to the Panhandle.

Hurricane damage hikes rates

Homeowner’s insurance policies typically cover wind damage from hurricanes, in addition to other calamities like fires, lightning strikes and theft.

Lately, Florida has been hit with a damaging series of hurricanes, including Hurricane Irma in 2017, Hurricane Michael in 2018 and Hurricane Ian in 2022. Those three storms alone caused nearly $200 billion in damage in Florida. That’s part of the reason premiums are rising in the state, according to Chris Dittman, head of Florida strategy at Aon Reinsurance Solutions.

“Florida has had its fair share of events in the last five or six years,” said Dittman. “So there is a bit of ‘Is this climate change? Is this the new norm? Should we increase the frequency that we expect these events in Florida?’”

The hurricanes put added strain on Florida’s already shaky insurance market. Even before Hurricane Ian struck, six Florida insurers had declared insolvency in 2022, meaning they couldn’t afford to pay out claims. Other insurers decided to leave the state entirely.

It’s part of a growing trend of insurance companies pulling out of vulnerable states with homes that are becoming uninsurable. State Farm and Allstate, the country’s two biggest insurers, stopped taking on new home insurance policies in California last year because of the state’s climate change driven wildfire risk, according to reporting from Axios. Major insurers began downsizing their risk in the Florida market decades ago, with devastating Hurricane Andrew back in 1992 starting the industry retreat.

Dittman said State Farm and Allstate now make up just a tenth of the home insurance market in Florida. “The two biggest carriers have a significantly smaller market share [in Florida] than in other big states,” said Dittman. The rest of the insurance market, he said, “gets filled in by smaller carriers that don’t have the same level of capital to cover claims, and that creates a little bit of instability.”

In Florida, Hurricane Ian drove up the cost of reinsurance, the insurance that insurance companies buy to make sure they can pay out claims when big disasters hit. Florida’s remaining insurance companies are expected to pass those costs onto their customers. Meanwhile, Citizens Insurance, the state-backed insurer of last resort that covers over 1.1 million Floridians, asked state regulators for permission to raise rates 14%.

Inflation strikes insurance

But hurricane damage is just one reason Florida’s insurance rates are rising so fast.

“Part of the story is inflation,” said George Hosfield, senior director of home insurance for LexisNexis Risk Solutions, which is owned by RELX, a company that provides analytics and data to business and professional organizations. “The cost of building materials has gone up a lot.”

The more it costs to hire a contractor and buy wood, concrete and other materials, the more insurers have to pay to rebuild a house — and the more they charge in premiums to cover their costs.

Other factors, like fraud and lawsuits, can also raise insurers’ costs. Florida leads the country in insurance lawsuits, although the state passed a law this year designed to make it harder for people to sue their insurance companies.

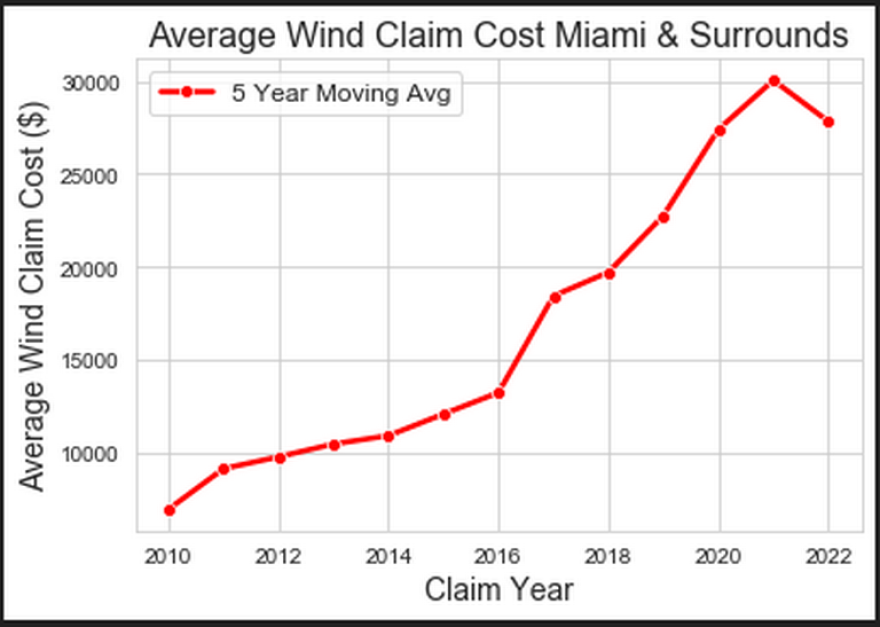

Hosfield also noted that as people build more expensive homes in vulnerable, disaster-prone areas, the average cost of insurance premiums rise. All of these factors, Hosfield said, are especially prevalent in South Florida.

Hosfield also noted that as people build more expensive homes in vulnerable, disaster-prone areas, the average cost of insurance premiums rise. All of these factors, Hosfield said, are especially prevalent in South Florida.

As a result, South Floridians are facing higher premiums than the rest of the state. “Areas that have higher claims costs are going to have higher rates in general,” Hosfield said.

Flood insurance rates are rising fast

Florida flood insurance rates are also rising fast, according to data from the Federal Emergency Management Agency, which runs the National Flood Insurance Program.

Homeowner’s insurance usually doesn’t cover flooding. In Florida, roughly one in five homes has a separate flood insurance policy, in addition to their standard homeowner’s policy.

That figure is set to rise quickly after the state legislature passed a law requiring anyone who has a Citizens home insurance policy to also buy flood insurance.

Floridians will face big flood insurance premium hikes as FEMA adopts a new system for calculating a property’s flood risk, dubbed “Risk Rating 2.0.” Floridians face a 131% premium hike, on average, under the new rating system, according to FEMA.

But with flood insurance, at least, Floridians won’t be the worst hit policyholders in the country.

Florida’s expected flood rate hikes are only the sixth biggest in the U.S. When the new prices fully kick in, Floridians will pay just the eighth highest flood insurance premiums in the county, with the average policy costing $2,213 a year. For comparison, Hawaiians with flood insurance will pay an average of $3,653 a year.

This climate report is funded by Florida International University, the Knight Foundation and the David and Christina Martin Family Foundation in partnership with Journalism Funding Partners. The Miami Herald retains editorial control of all content.

Copyright 2023 WLRN 91.3 FM. To see more, visit WLRN 91.3 FM.