Buying a house in Jacksonville continues to be out of reach for many, with a new study highligting just how much debt can get in the way of home ownership.

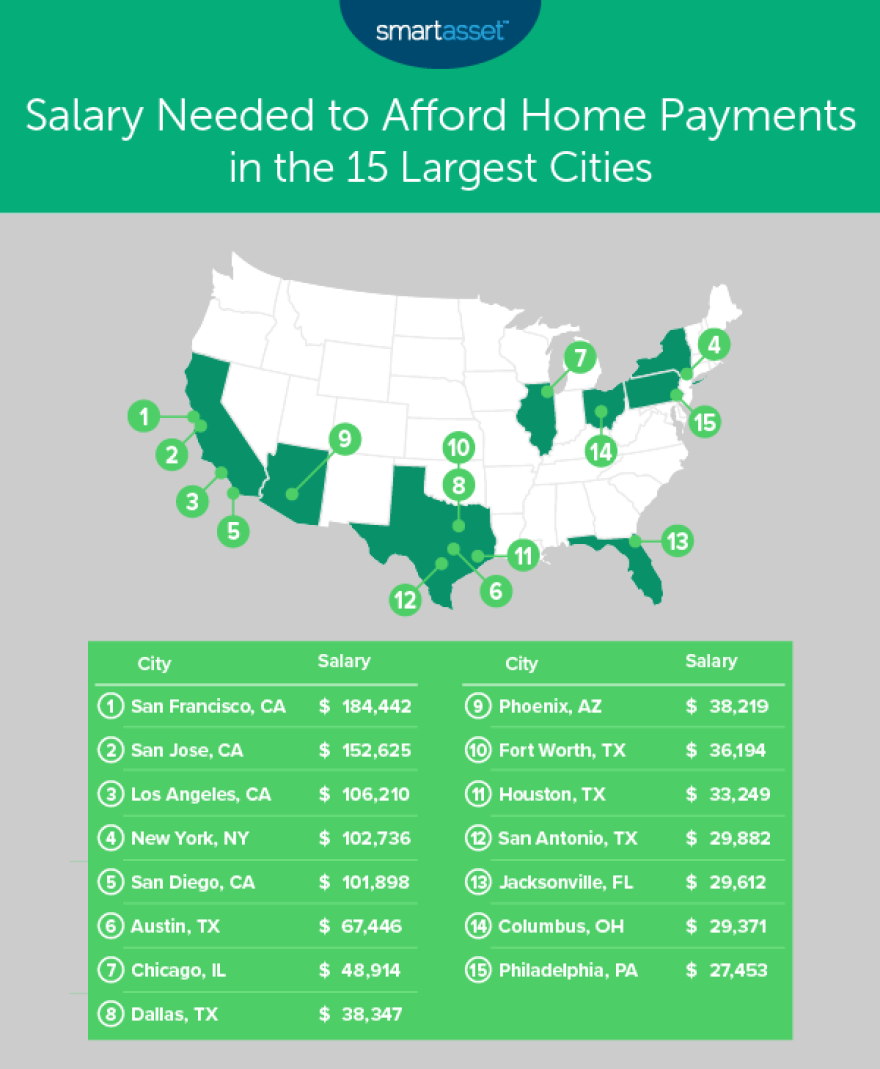

SmartAsset estimated, to buy a $183,700 home, the median home price in Jacksonville, buyers would need a household income of at least $29,612 a year. But that’s assuming no debt in the household. The personal finance technology company found for people with debt, the salary needed to afford a home can more than double.

Related: Experts Say Jacksonville Has An Affordable Housing Shortage

For an average homeowner with $1,000 in additional non-mortgage debt per month, the study said, the salary needed to afford the home jumps to $62,945 per year.

For households with car loans, college loans and credit card debt, the number can go even higher.

SmartAsset based its numbers on a monthly mortgage of $888, which assumes a 30-year mortgage at 4% interest along with a 20% down payment, real estate taxes, home insurance and other fees.

The company looked at the 15 largest cities in the country. Jacksonville was among the most affordable, topped by only Columbus, Ohio, and Philadelphia.

On average, the median home value across the largest 15 cities in the country is roughly $418,500, according to SmartAsset. The median home value ranges from almost $1.2 million in San Francisco to less than $170,000 in Philadelphia.

SmartAsset’s full report, along with the methodology it used, is available here.

Bill Bortzfield can be reached at bbortzfield@wjct.org, 904-358-6349 or on Twitter at @BortzInJax.