Homes facing high flood risks are selling for nearly 14% more than the typical home with low flood risk, according to a new report from Redfin.

That record 13.6% premium for high-risk homes is up from a premium of 10.1% in the first quarter of 2020 and 7.2% in the first quarter of 2019.

On average, homes with high flood risks have sold for about 7% more than homes with low flood risk since 2013. That’s likely because many of those high risk homes are luxury waterfront properties, according to the real estate company Redfin. That premium has increased during the COVID-19 pandemic as wealthy home buyers leave big cities and buy waterfront properties.

Related: Real Estate And Sea Level Rise: A Buyer's Guide

"Americans are buying the beach houses they always dreamed of because they have the flexibility to work from wherever they want," said Redfin Senior Economist Sheharyar Bokhari. "While flood risk is intensifying in many parts of the country, it doesn't seem to be a deal breaker for a lot of homebuyers. This may be because buyers aren't aware they're purchasing a home in a flood plain or just don't view it as an immediate danger. Places with high flood risk are also often home to large concentrations of retirees, many of whom don't see climate change as a threat they need to worry about in their lifetime. Florida is one example."

Areas that are prone to flooding are also seeing an increase in the number of homes sold. Sales of homes at high risk of flooding rose by about 18.6% year over year in the first quarter, compared to a 9.6% gain in sales of homes that have a low flood risk.

In Jacksonville, homebuyers frequently ask about flood risk, but according to local Redfin real estate agent Heather Kruaai, flood risk almost never leads to them backing out of a purchase.

"If you buy a home on the water in Florida, flooding is just something that comes with the territory. Most buyers understand that," Kruayai said. "A lot of out-of-state buyers have been moving here during the pandemic and purchasing waterfront properties, but there are also locals who are looking for space to spread out because the city has become so congested. Even if you wanted to negotiate a lower price due to flood risk, you'd have a tough time because we're in such a hot seller's market."

There are about 43,000 properties in Jacksonville that are at a high risk for flooding, according to data from the First Street Foundation, and that number is expected to climb as the climate continues to change and sea levels rise.

Related: As Seas Rise, Florida Will Likely Lose More Coastal Property Value Than Any Other State

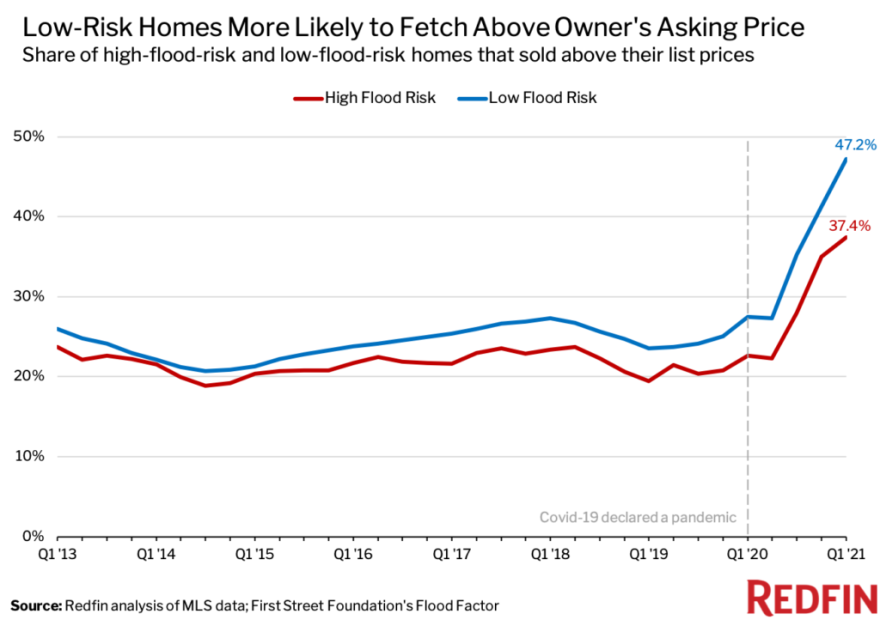

Even though home prices and sales growth are both higher for homes facing higher flood risks, homes with low flood risk are more likely to sell at higher prices than their owners asked for. During the first quarter 47.2% of low flood risk homes sold for more than they were listed for compared to 37.4% of high flood risk homes, a record gap since Redfin started keeping records back in 2013.

According to Bokhari, properties with low flood risk usually cost less than those with high flood risk because they don’t usually have waterfront views. And because those lower risk properties are more affordable, buyers face more competition, which drives prices up.

Redfin is just one of several real estate websites that have started sharing property-level flood risk data online to help home shoppers figure out if the properties they’re looking at are in areas prone to flooding and to help people decide whether they should purchase flood insurance.

Brendan Rivers can be reached at brivers@wjct.org, 904-358-6396 or on Twitter at @BrendanRivers.